By Dr. Seleem R. Choudhury, December 10, 2020

The term "patient-centered care" is in vogue and utilized by health system administrators, marketing gurus, hospital staff, and clinicians alike. It's a catchy phrase that resonates with stakeholders, and it sounds like something every healthcare organization would heartily embrace. However, the heart of patient-centered care and its implications for how care is actually provided to patients is not well understood.

The Institute of Medicine defines patient-centered care as "providing care that is respectful of, and responsive to, individual patient preferences, needs, and values, and ensuring that patient values guide all clinical decisions" (HealthLeads, 2018; Wolfe, 2001). The goal of patient-centered care is focused primarily on the health outcomes of the individual rather than the entire population (NEJM Catalyst, 2017). However, by prioritizing the individual's health, populations' health outcomes are improved as well (Cramm & Neiboer, 2016). Additionally, patient-centered care presents possible economic advantages for both hospitals and patients (David, Saynisch, & Smith-McLallen, 2018).

However, there are many barriers that must be overcome to live up to the aspirational definition of patient-centered care and experience the benefits this approach offers.

Barriers to patient-centered care

An article released last year by Academy Health outlines many of the barriers to patient-centered care (Sinaiko, Szumigalski, Eastman, & Chien, 2019). It highlights that these barriers are "pervasive" within the healthcare system. The current lack of agility within healthcare as an industry has limited the customizability of care delivery, and there are many broad sections of the population that are paying the price.

Reimbursements

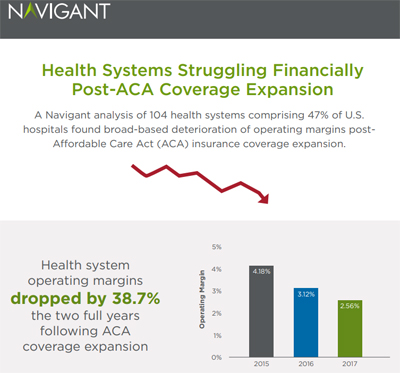

Erasmus spoke of "the talking power of money," and it is true that "money talks" centuries later in today's healthcare system. Many healthcare systems continue to utilize fee-for-service. While this approach is hotly debated amongst healthcare professionals and economists, many believe fee-for-service models create incentives for providers to encourage face-to-face or volume building visits, and are widely indicted for promoting care that is inefficient, uncoordinated, and too often fails to meet the needs of patients (Agency for Healthcare Research and Quality, 2002).

The fee-for-service system serves to drive up volume and encourages hospital and community health organizations to make money and support their healthcare system rather than the needs of the patient. This may lead providers to perform unnecessary surgeries, x-rays, or lab work, to name a few common examples, in order to increase revenue, rather than focus on the patient's desire to receive only the care they need at a cost they can afford.

It is recognized, however, that the fault does not just rest with the organization. Often, the regulatory burden on providers and hospitals is unrealistic and cumbersome, stifling innovation (Secretary of Health and Human Services, 2018). This can lead to the tail wagging the dog with organizations feeling pressure to meet regulatory needs before addressing patient needs in order to gain reimbursements.

Organizational culture

Unsurprisingly, the culture of the organization impacts patient outcomes and the practice of patient-centered care (Hahtela, McCormack, Doran, Paavilainen, Slater, Helminen, & Suominen, 2017). It is not enough to simply tout a patient-centered approach in annual reports, periodic training, glossy posters, mission statements, email signatures, or quick notes in a staff meeting. Everyone associated within the organization—from executives to clinicians to non-clinical support staff to volunteers—must hold attitudes and beliefs consistent with patient-centeredness (Gorli, Liberati, Galuppo, & Scaratti, 2016; Agha, Werner, Reddem, Huseman, Long, & Shea, 2018).

The organization must become transformational to make patient-centered care a reality, not just a nice sentiment. This will require training for all employees and a mindset shift from the top down.

Inadequate trust

Patients often do not trust their clinician's management of their health. This is due in part to a lack of transparency combined with the steadily rising cost of care over decades. Healthcare is the only industry in the world where consumers have no idea how much money they will be required to spend on a service prior to receiving it. Clinicians are unable to tell their patients how much their care is going to cost—how could there not be a lack of trust?

We see evidence of this lack of trust consistently in issues with medication compliance among patients with chronic medical conditions. According to a recent article in Practical Pain Management, "approximately 125,000 people with treatable diseases die each year in the U.S. because they do not take their medication as prescribed, while 10% to 25% of hospital and nursing home admissions result from uninitiated or incomplete prescribed treatment plans" (Cosio & Demyan, 2020). Data suggests that if a stronger, more respectful, and trusting relationship exists with the patient, then the patient is likely to be more compliant with their treatment (Sladdin, Ball, Bull, & Chaboyer, 2017).

Social determinants of health

Social determinants of health include the social factors that impact a patient's ability to achieve health and wellness. We live in an electronic age, and it seems bizarre that this crucial information is missing from patients' medical history. But the fact is that data on social determinants of health is not consistently collected, thus stunting patient-centered care efforts.

A lack of understanding or reliable methods for collecting this information translates to a lack of understanding of the needs of the patient. When providers do not have information on what patients have and what they need—whether poverty, educational issues, or homelessness, for example—it impacts their ability to achieve positive health outcomes for their patients (Heath, 2017).

Pandemic

A barrier not mentioned in the Academy Health article is the current global pandemic. COVID-19 has impacted patient-centered care, especially as care delivery is focused on the most acute cases (Carlos, Lowry, & Sadigh, 2020). Staff are stretched too thin to take into account patient preferences.

Non-COVID treatment often comes with a list of precautions to prevent spreading the virus and less flexibility in care and support options. Many hospitals have suspended visitors, so the patient is left alone without their loved ones, who often act as a support system and a channel of communication with care providers.

Strategies and solutions

Despite the many substantial barriers to implementing patient-centered care in the healthcare industry, hospitals and healthcare professionals are finding ways to overcome these obstacles and put the needs of the patient first. A 2018 report supported by the Robert Wood Johnson Foundation, titled Moving Patient-Centered Care Forward: How Do We Get There?, identifies several actionable strategies.

Improve diversity.

Improved diversity among the healthcare workforce will result in increased opportunities for patients to receive care from someone who shares the same racial or ethnic background. This is essential for improved individual health outcomes, as data has repeatedly shown that compliance with physician recommendations is heightened when patients identify with the ethnicity of their provider and clinical team (Khullar, 2018).

In addition, a study found that patients were more likely to give the maximum patient rating score and were more compliant with the treatment regime when they identified with their provider's ethnicity (Takeshita, Wang, & Loren, 2020). In addition to hiring a more diverse workforce, hospitals must also collect information regarding patient ethnicity, and take steps to take ethnicity into account in a patient's care.

Embrace innovation.

The healthcare industry needs to think outside the box not only when it comes to improving care, but also reimbursement for care. Patient-centered care is increasingly delivered in teams, both within healthcare systems and through referral relationships with other organizations. A lot of work goes on behind the scenes that is often not reimbursable. Developing an innovative system that rewards collaboration will help undo a payment system that does not adequately compensate for this work.

Collaborate with community organizations.

The African proverb, "It takes a village to raise a child," rings true for organizations that have embraced patient-centered care. Too often hospitals think they are the be-all-end-all of their patients' care, but in reality, there are many people and organizations, such as schools, food banks, and local agencies, to name a few, that contribute to a person's health. Hospitals must change their focus from protecting their volume and growing their service line to embracing their role as a contributor to the health of their community for the sake of their patients.

Serve the "whole patient."

Transforming the culture of an organization to deliver care in a way that better serves the "whole" patient is a complex endeavor. To put a patient's needs first requires that the organization be willing to put its own needs second. A commitment within the organization to permit staff to address patient needs as they arise, even if the service is not in their job description, sounds good on a mission statement or strategic plan. However, it will require hospitals to invest in training their staff and creating a culture that focuses on customer service, respect, and patient empowerment.

Promote transparency.

A lack of transparency inevitably leads to a lack to trust, and we must listen to patients' and the government's demands for increased transparency in the healthcare industry. The 21st Century Cures Act, set to take effect in April 2021, will help all patients to have immediate electronic access to their detailed notes and records. The intent is to lower costs, create improved trust with transparent conversation between provider and the patient, and empower the patient to make more informed healthcare decisions.

Transparency doesn't end there. There needs to be greater openness and ease in hospital billing practices, billing and cost understanding, and the ins and outs of the insurance reimbursement system. Hospitals' pay codes are indecipherable to patients trying to interpret their billing statements. Patients need to see actual costs if they are to be empowered to make wise decisions for their physical and financial health.

Rethink compliance.

Regulations meant to ensure that all patients receive quality care have unwittingly turned the healthcare industry into a tick-box culture where hospitals are incentivized to provide care to the lowest common denominator to keep agencies off their back.

There is something for healthcare leaders to ponder in Amazon CEO Jeff Bezos's statement to shareholders in 2016:

"Good process serves you so you can serve customers. But if you're not watchful, the process can become the 'thing.' This can happen very easily in large organizations. The process becomes the proxy for the result you want. You stop looking at outcomes and just make sure you're doing the process right."

In healthcare as well as in the tech sector, the process of ensuring regulatory compliance can too easily become the "thing," much to the chagrin of clinicians. As a result, care can become encumbered, slow, and legalistic, rather than dynamic, patient-focused, and friendly (Sims, Leamy, Levenson, Brearley, Ross, & Harris, 2020).

It is clear that to deliver patient-centered care organizations must not be held hostage to meeting regulatory requirements. Instead, they should look beyond the minimum and understand their patients when designing a patient-centric model that not only surpasses the minimum requirement for compliance, but also delivers clinical excellence.

Placing the patient in their rightful place at the center of all healthcare organizations do is an ongoing journey and not an endpoint. Embracing patient-centered care is a paradigm shift that will require healthcare partnership, adoption and acceptance by every person in the healthcare organization, and openness to innovative approaches in an ever-evolving and complex healthcare system.

Read more from Dr. Seleem Choudhury at seleemchoudhury.com

References:

Agency for Healthcare Research and Quality (2002). Improving Health Care Quality.

Agha, A., Werner, R., Keddem, S., Huseman, T., Long, J., & Shea, J. (2018). Improving Patient-centered Care. Medical Care, 56(12).

Bezos, J. (2017). 2016 Letter to Stakeholders. Amazon News.

Brickley, B., Sladdin, I., Williams, L., Morgan, M., Ross, A., Trigger, K., & Ball, L. (2019). A new model of patient-centred care for general practitioners: results of an integrative review. Family Practice, 37(2).

Carlos, R., Lowry, K., & Sadigh, G. (2020). The Coronavirus Disease 2019 (COVID-19) Pandemic: A Patient-Centered Model of Systemic Shock and Cancer Care Adherence. Journal of the American College of Radiology, 17(7).

Cosio, D., & Demyan, A. (2020). Adherence and Relapse – How to Maintain Long-Term Gains in Patients with Chronic Conditions. Practical Pain Management, 20(6).

Cramm, J. & Nieboer, A. (2016). Is "disease management” the answer to our problems? No! Population health management and (disease) prevention require “management of overall well-being.” BMC Health Services Research.

David, G., Saynisch, P., & Smith-McLallen, A. (2018). The economics of patient-centered care. Journal of Health Economics, 59.

Delaney, L. (2018). Patient-centred care as an approach to improving health care in Australia. Collegian, 25(1).

Gorli, M., Liberati, E., Galuppo, L., & Scaratti, G. (2016). Promoting Patient Engagement and Participation for Effective Healthcare Reform. IGI Global.

Hahtela, N., McCormack, B., Doran, D., Paavilainen, E., Slater, P., Helminen, M., Suominen, T. (2017). Workplace culture and patient outcomes: What's the connection? Nursing Management, 48(12).

Health Leads (2018). Patient-Centered Care: Elements, Benefits And Examples

Heath, S. (2017). Using Social Determinants of Health in Patient-Centered Care. Patient Engagement Hit.

Hughes, T., Varma, V., Pettigrew, C., & Albert, M. (2015). African Americans and Clinical Research: Evidence Concerning Barriers and Facilitators to Participation and Recruitment Recommendations. The Gerontologist, 57(2).

Khullar, D. (2018). Even as the U.S. grows more diverse, the medical profession is slow to follow. The Washington Post.

Moretta Tartaglione, A., Cavacece, Y., Cassia, F. and Russo, G. (2018). The excellence of patient-centered healthcare: Investigating the links between empowerment, co-creation and satisfaction. The TQM Journal. 30(2), pp. 153-167.

National Institutes of Health (2020). The 21st Century Cures Act.

NEJM Catalyst (2017). What Is Patient-Centered Care?

Ogden, K., Barr, J., & Greenfield, D. (2017). Determining requirements for patient-centred care: a participatory concept mapping study. BMC Health Services Research.

Robert Wood Johnson Foundation (2018). Moving Patient-Centered Care Forward: How Do We Get There?

Ruppar, T., Ho, P., Garber, L., & Weidle, P. (2017). Overcoming Barriers to Medication Adherence for Chronic Diseases. Centers for Disease Control and Prevention.

Secretary of Health and Human Services (2018). Secretarial Response.

Sims, S., Leamy, M., Levenson, R., Brearley, S., Ross, F., & Harris, R. (2020). The delivery of compassionate nursing care in a tick-box culture: Qualitative perspectives from a realist evaluation of intentional rounding. International Journal of Nursing Studies, 107.

Sinaiko, A., Szumigalski, K., Eastman, D., Chien, A. (2019). Delivery of Patient Centered Care in the U.S. Health Care System: What is standing in its way?. Academy Health.

Sladdin, I., Ball, L., Bull, C., & Chaboyer, W. (2017). Patient‐centred care to improve dietetic practice: an integrative review. Journal of Human Nutrition and Dietetics, 30(4), 453-470.

Takeshita, J., Wang, S., Loren, A., et al. (2020). Association of Racial/Ethnic and Gender Concordance Between Patients and Physicians With Patient Experience Ratings. JAMA Network Open.

Wall Street Journal (2015). Should the U.S. Move Away From Fee-for-Service Medicine?

Wolfe, A. (2001). Institute of Medicine report: Crossing the quality chasm: a new health care system for the 21st century. Policy, Politics, & Nursing Practice, 2(3), 233-235.

Yuan, S., Freeman, R., Hill, K., Newton T., & Humphris, G. (2020). Communication, Trust and Dental Anxiety: A Person-Centred Approach for Dental Attendance Behaviours. Dentistry Journal.Communication, Trust and Dental Anxiety: A Person-Centred Approach for Dental Attendance Behaviours.

Post a Comment By

Post a Comment By  Riddle, Clive |

Riddle, Clive |  Wednesday, November 10, 2021 at 03:25PM tagged

Wednesday, November 10, 2021 at 03:25PM tagged  Provider Payments|

Provider Payments|  Surveys & Reports|

Surveys & Reports|  health plans

health plans