What do Copernicus and Today’s Healthcare Leaders Have in Common?

By Maria D. Moen, May 13, 2022

Both Use Data to Change the World as We Know It

In 1543, Copernicus was the first astronomer to propose the theory that the earth and other planets rotated around the sun, which contradicted popular thought at the time that the earth was the center of the universe. Through mathematical and astrological analysis over the course of many years, Copernicus effectively moved the sun to the center of the universe with his simple and elegant explanation of the retrograde motions of the planets.

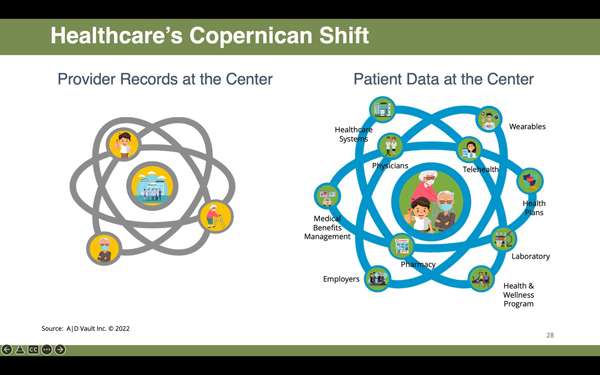

Today, a similar “Copernican Shift” is taking place in healthcare as innovative leaders tackle the hard problems of staffing shortages, reduced patient loyalties due to trust and health equity concerns related to the healthcare system as a whole, and the need to bring forward strategies for growth to rebuild their own particular business models post-COVID. Turning to new ways of looking at how to regain diminished revenue and increase market share by leveraging the data that has been collected about their patients, combined with the insights that data is revealing, has led to a shift in the balance of power from the patient revolving around various healthcare providers to the patient being the center of the healthcare universe, around which their healthcare providers revolve to deliver coordinated, complementary care. This foundational change in how providers perceive and treat their patients as a key recovery strategy post-COVID is gaining traction as they derive strategies to make the transition from traditional fee-for-service to value-based care models.

For decades, healthcare decision-making was based principally on a provider’s own records which were often in paper files and siloed across the various organizations that treated the same patients. But a paradigm shift is taking place, thanks to the power of technology, to better connect providers and patients in ways that produce more data-driven decision-making, better clinical outcomes, and greater patient satisfaction. Today we find ourselves in a watershed moment that could rightfully be called a digital health revolution as new technology platforms and smart devices continue to disrupt, in a positive sense, the way information is collected, the way healthcare is delivered, and the way consumers are able to personally interact with the healthcare system. As a result, emerging technologies have evolved from a “nice to have” to a “need to have.” Now that this fuse has been lit, all indications point to an ever-increasing acceleration of this movement in 2022 and beyond.

It is encouraging to see the healthcare ecosystem populated with an increasing array of marvelous innovations capable of efficiently performing many useful, previously resource-intensive functions. These solutions put our industry on a journey to even greater achievement while also providing visibility into how we can expect the digital healthcare engine to evolve in the near term. In this atmosphere of looking at old problems in new ways with more powerful tools, three truths have been revealed:

1. The best reporting tools look forward, not backward. Business leaders don’t adopt technology based on capabilities alone. They often select solutions based on the reporting and analytical insights they can gain and whether those insights translate to meaningful business intelligence. Reporting that looks forward and projects what “could” happen as delivery systems are incrementally adjusted based on what “did” happen, gives clarity to a wide array of sectors within healthcare. In doing so, the shift to put the patient and what they want at the center of treatment decisions has become more mainstream and less innovation.

When the power of historical and current data is harnessed to reveal issues or barriers to increased productivity and higher patient satisfaction, those matters can be confronted in a timely manner by the organization before they snowball into large-scale problems. Monitoring patient trends using data available (but previously not actively used) to create insights across populations also allows healthcare organizations to track patient behaviors as part of anticipating how to increase utilization and satisfaction. This information helps tailor care to the individual which improves outcomes and reduces unwanted events. In short, effective reporting isn’t merely about understanding what has happened in the past but is also about providing the intelligence needed to move forward with confidence.

2. Healthcare leaders need unencumbered access to their data. If leaders are to optimize healthcare delivery and derive strategies to address the issues that hinder growth and increase revenue, they need the ability to benchmark the performance of specific processes and functions. Limiting access to data, whether intentional or unintentional, only impedes these improvements and weakens the organization as a whole. The right information analysis and understanding of the tools available allows healthcare professionals to spot weaknesses, identify strengths, and predict events before they occur.

Without access to these insights, management is unable to make timely, data-driven decisions or easily share information across organizations to support new patient-focused value-based care initiatives. That’s why comprehensive patient data tracking, reporting, and analytics tools are important tools to delivering actionable business intelligence.

3. Data must be integrated across care settings. The overarching goal of healthcare is to provide patients with interventions that render the best possible outcomes. This goal, however, is impeded when patient information resides in multiple locations and is not readily accessible as the patient receives care from multiple providers in various care settings. Transitions in care – between providers or across levels of care – are particularly vulnerable breaking points and serve to make the need for immediate access to information about the patient regardless of where care is delivered all the more critical.

Ensuring data privacy for the patient being served can further complicate the process of moving personal health information across the healthcare continuum, but fortunately interoperability standards are being embraced for seamless and secure data exchange and accessibility from one system to another. These standards give patients the opportunity to engage with their providers directly from remote locations or when due to illness or injury they can’t speak for themselves, allowing them to bridge provider knowledge gaps, information silos, and be more active participants in their care.

The ability to bring patient voice into the center of healthcare delivery is continuing to rise in demand as patients welcome the shift from being moved from one provider to another without the ability to impact the care they receive to being able to influence their own care across providers. One outstanding example of this is the increased attention being paid to advance care planning (ACP) and its rightful place in a digital world. An ACP document can assure patients that their own voice – not the “voice” of a hospital, employer, health plan, or any government – will be heard and used to inform the care they do or don’t desire. Documents such as an advance directive or an advance care plan empower people to express their priorities for quality of life and memorialize what makes life meaningful to them. ACP documents allow individuals to specify where they want to receive treatment – at home, or in a senior care setting or in a hospital, for example. And they provide the opportunity to share those preferences and priorities for their life and healthcare decisions with their advocates and the medical teams who will ultimately make treatment decisions for them. Here, too, technology is playing a major role as digital platforms exist that allow for ACP documents and portable medical orders such as DNR orders and POLST forms to be easily created by patients or providers in a streamlined approach, securely stored and, most importantly, made accessible to family, caregivers, and healthcare providers 24 hours a day, 7 days a week, every day of the year.

This is indeed an exciting time in healthcare as the appetite for innovations in technology and the use of data to create new insights to change healthcare delivery models are moving the patient to the center of care and creating a more personalized and responsive delivery system. As the Copernican Shift continues to evolve, healthcare organizations and providers will continue to embrace new tools and analytics as part of a truly connected healthcare ecosystem. I'm excited to see what the future will bring!

Maria D. Moen is Senior Vice President of Innovation & External Affairs at ADVault, Inc., the nation’s leader in digital advance care planning solutions. Its end-to-end, cloud-based, SaaS solutions empower patients to create, store, and share their ACP documents in a secure, protected platform. ADVault also enables healthcare providers to manage their ACP activity and supports providers’ creation, update, storage of their patients’ healthcare wishes in a secure, electronic registry and repository that can be accessed by medical teams anytime, anywhere. http://www.advaultinc.com/

Share This Post

Share This Post