The Facts of Managed Care

By Clive Riddle, January 10, 2020

The MCOL Managed Care Fact Sheets have just been updated, an ongoing online feature provided since the 1990s. Here’s some highlights:

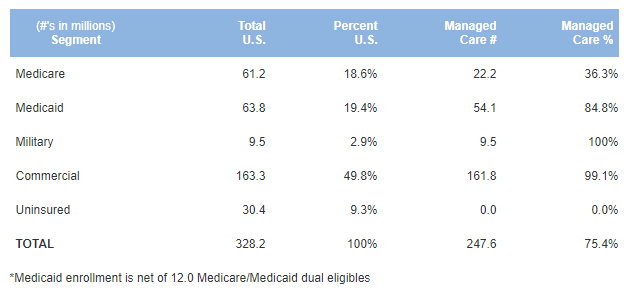

Overall national managed care penetration is now 75.4%. Here’s a breakdown by payor segment, based on 2019 data:

Sources: (see Note 1)

Here is the total national managed care enrollment by coverage type, based on 2018 data:

Health Maintenance Organization (HMO): 94.8 million

Preferred Provider Organization (PPO): 165.8 million

Point of Service (POS): 4.8 million

High Deductible Health Plan (HDHP): 15.6 million

Total* 81.0 million

* The above total enrollment exceeds the total actual national managed care population due to double counting of A) spouses and dependents who have dual coverage; and B) HDHP plans that are also classified as PPO, HMO or POS

Sources: (see Note 2)

And here is major national health plans enrollment as of September 30, 2019:

United Health Group: 49.4 million

Anthem: 41.0 million

CVS Health (Aetna): 22.8 million

Humana: 16.6 million

CIGNA HealthCare: 17.1 million

HCSC: 16.0 million

Centene*: 15.3 million

Kaiser Permanente: 12.2 million

Wellcare*: 6.4 million

Molina: 3.3 million

*Centene/Wellcare Enrollment is reported separately, prior to public reporting of combined membership from merger

Source: Compiled by MCOL from company financial reports

The Managed Care Fact Sheets also include:

- National HMO Enrollment Graph

- Medical Cost Components

- Premium Rate Increase Trends Graph

- 2020 Premium Rate Increase Estimates

Notes

1: National Managed Care Penetration sources:

- MCMS Fast Facts: www.cms.gov/fastfacts/

- Kaiser Family Foundation State Health Facts Total Medicaid MCO Enrollment http://kff.org/other/state-indicator/total-medicaid-mco-enrollment/

- People Enrolled in Medicare and Medicaid, Fact Sheet March 2019, CMS Medicare-Medicaid Coordination Office https://www.cms.gov/Medicare-Medicaid-Coordination/Medicare-and-Medicaid-Coordination/Medicare-Medicaid-Coordination-Office/Downloads/MMCO_Factsheet.pdf

- Tricare Prime Beneficiaries: https://www.tricare.mil/About/Facts

- Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, 2018, Division of Health Interview Statistics, National Center for Health Statistics https://www.cdc.gov/nchs/data/nhis/earlyrelease/insur201905.pdf

- U.S. Census Bureau Quick Facts, United States https://www.census.gov/quickfacts/fact/table/US/PST045216

2. National Managed Care Enrollment sources:

- 2018 PayerDigest Series, Sanofi Managed Care Digest Series www.managedcaredigest.com

- Health Coverage State-to-State, 2019 www.ahip.org/wp-content/uploads/StateDataBook_2019-FINAL.pdf

Share This Post

Share This Post