By Clive Riddle, August 4, 2016

MCOL’s Managed Care Fact Sheet webpages are being updated to reflect current data, so I took this opportunity to grab some Facts and provide this preview, baking this snapshot of managed care pie.

National HMO Enrollment is 92.4 million for 2016, up from 85.7 million in 2015, and a recent low of 66.8 million in 2007. The previous high was 81.3 million in 1999, just before managed care backlash whipped the numbers down. (1)

How does the managed care enrollment pie divide up? 33% are enrolled in HMOs, 57% in PPOs, 2% in POS plans and 7% in HDHPs.(1) - (3) The top five national health plans by enrollment are United Health Group – 48.0 million; Anthem – 39.6 million; Aetna – 23.0 million; Cigna – 15.1 million and Health Care Service Corporation – 15.0 million. (14)

And what portion of the total national pie does managed care represent? 31% of Medicare beneficiaries are enrolled in Medicare Advantage plans, 63% of Medicaid enrollees are in Medicaid managed care plans, and 99% of commercial lives are enrolled in managed care. Factor in the 9% of the population that is still uninsured, and 70% of the total population is enrolled in some form of managed care plan. (4) – (10)

What are current resource use benchmarks in managed care – or how much of the pie is being eaten? HMO Hospital inpatient days per 1,000 members per year are 1,639 for Medicare, 395 for Medicaid and 231 for commercial; Commercial PPO are 237. HMO Physician visits per member per year are 10.2 for Medicare, and 4.8 for Medicaid and Commercial; Commercial PPO are 4.7. HMO Prescriptions per member per year are 29.9 for Medicare, 9.6 for Medicaid and 9.0 for Commercial; Commercial PPO are 11.8. (2) (11)

Getting back to pie, medical cost components – for a family covered by a PPO – are sliced up 31% for inpatient, 30% of physician, 19% for outpatient services, 17% for pharmacy and 4% for other services. (12)

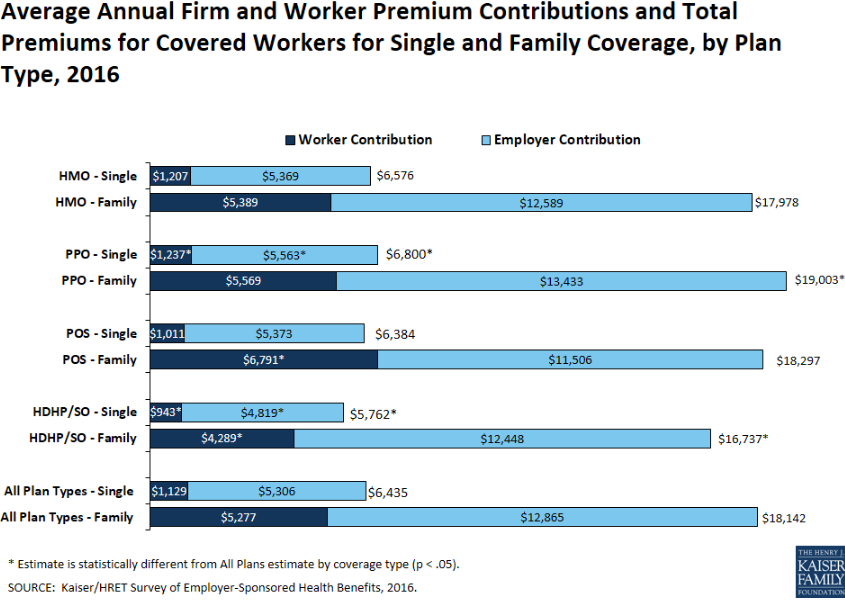

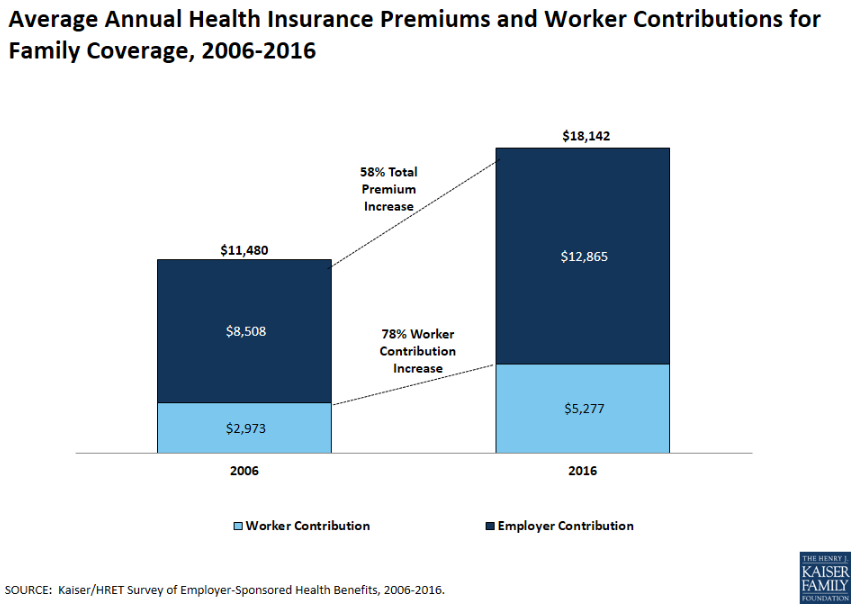

So what does the pie cost? Single health plan premiums average $518 for HMOs and $548 for PPOs, and family premiums average $1,437 for HMOs and $1,539 for PPOs. Premium increases are estimated to be 4.3% in 2016, and have been under 5% after 2011, and under 8% after 2003. In 2002 – post managed care backlash - they were 14.7%, but they were 8.1% or less in the pre managed care backlash era from 1993 to 2000, including a decrease of 1.1% in 1994. Before that, double digit increases were the norm for a number of years.

(1) Total HMO Enrollment - Kaiser State Health Facts; Data Source: Health Leaders InterStudy, a Decision Resources Group Company July 2015 Data, accessed August 2016 www.statehealthfacts.org

(2) 2015 HMO-PPO Rx Digest Series, Sanofi www.managedcaredigest.com

(3) New Census Survey Shows Continued Growth in HSA Enrollment, AHIP November 11, 2015 https://ahip.org/new-census-survey-shows-continued-growth-in-hsa-enrollment/

(4) CMS Fast Facts: www.cms.gov/fastfacts/

(5) Medicaid Enrollment Report as of January 2016: https://www.medicaid.gov/medicaid-chip-program-information/program-information/downloads/january-2016-enrollment-report.pdf

(6) Kaiser Family Foundation State Health Facts Total Medicaid MCO Enrollment http://kff.org/other/state-indicator/total-medicaid-mco-enrollment/

(7) CDC Fast Facts, National Center for Health Statistics, Health, United States 2016: http://www.cdc.gov/nchs/

(8) Tricare Prime Beneficiaries 2016: www.tricare.mil/About/Facts/BeneNumbers.aspx

(9) CDC May 2016: Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, 2015 http://www.cdc.gov/nchs/data/nhis/earlyrelease/insur201605.pdf

(10) Total U.S. Population data as of April 2016, U.S. Census Bureau: www.census.gov

(11) 2015 Public Payer Digest Series, Sanofi www.managedcaredigest.com

(12) Milliman Medical Index, Milliman, May 24, 2016 http://www.milliman.com/mmi/

(13) Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2015. www.kff.org

(14) MCOL research from 2016 company reports

Share This Post

Share This Post