By Clive Riddle, December 21, 2016

It’s that time of year when healthcare prognosticators point out predictions, priorities, and progressions for the coming year. Here is a tour of some of what is being said about healthcare in the new year, starting with overall trends and then examining some specific topics:

PwC’s Health Research Institute releases an annual list that many stakeholders look to. Here is their Top health industry issues of 2017, which they label as “a year of uncertainty and opportunity.” PwC devides these trends into three components, stating “many of 2017’s Top issues highlight how this shift toward value is occurring, and how traditional health organizations and new entrants are responding to it. There are three main tactics that organizations will use to address this shift to value – they will adapt, they will innovate and they will build new programs and approaches to their work.”

Adapt for value

1. Under a new administration, the fate of the ACA remains unclear

2. Pharma’s new strategic partner? Patients

3. Easing the training wheels off value-based payment

4. Insert your card here for healthcare

Innovate for value

5. Paging Dr. Drone: It’s time to prepare for emerging technologies

6. The battle against infectious diseases sparks invention

7. Rx cauliflower: Nutrition moves to population health

Build for value

8. Putting the brakes – gently - on drug prices

9. A year of new partnerships and collaborations

10. Preparing medical students for work in a value-based world

Black Book’s year end C-suite polls produced a list of 9 Healthcare Tech Trends in The New Year of Uncertainty:

1. Technology Budgets Stagnate, Purchases through Q2 largely will be based on current business need.

2. Electronic Data Warehouses (EDW) move to the top of short term priorities.

3. Renewed and upgraded Enterprise Resource Planning Systems (ERP) swings back into importance, now for Value Based Care Costing.

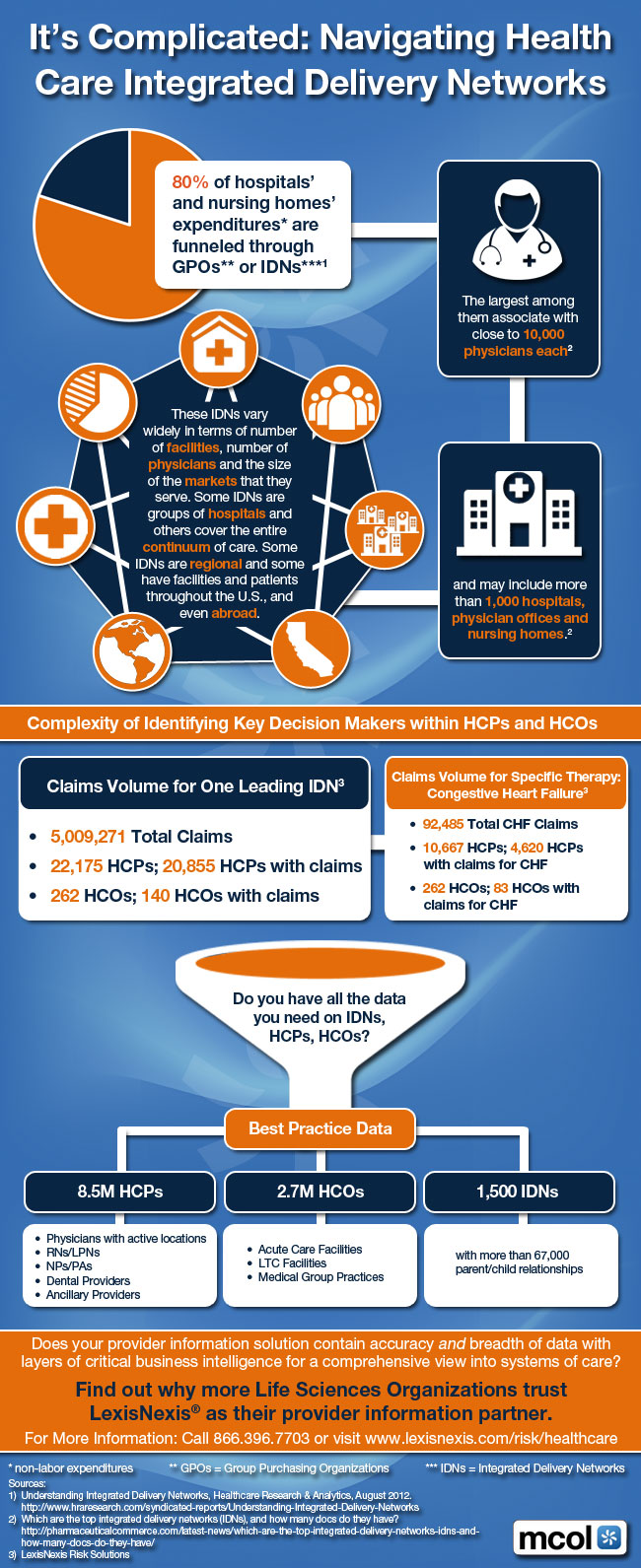

4. Financially stable, regional IDNs are spending big dollars toward extended connectivity while the rest of the pack looks on.

5. Providers keep watch and wait for Large Scale Healthcare Cyber Attacks before forming a Better Defense.

6. Hype around the Cloud quiets down as it becomes the primary way to build enterprise architecture.

7. Focus on Front End and Middle Office Business Office Functions & RCM Outsourcing intensifies.

8. Skilled hospital tech staff recruitment is even more challenging.

9. Interest in Precision Medicine initiatives continue but few have commitments to buy for first half of the New Year.

The Medical Futurist Newsletter shared these top technologies with the biggest promise for 2017:

1) A new era in diabetes care

2) Precision medicine in oncology

3) Narrow artificial intelligence in US clinics

4) Driverless trucks or cars will include health sensors

5) New service in nutrigenomics

6) SpaceX and NASA will realize they need a digital health masterplan to reach Mars

7) The genome editing method CRISPR in clinical trials

8) A big tech company will step into health

9) An insurance company launches a wearable sensor package

10) The surgical robot by Google and Johnson&Johnson will compete with daVinci

11) Vocal biomarkers: the future of diagnostic medicine

12) Pharma will start using massive AI in clinical trials and drug research

13) A company will make the 3D printed cast a real choice

Also on the topic of technology, Becker's ASC Review features an article 5 healthcare technology trends taking center stage in 2017 summarizing a list of “San Mateo, Calif.-based PokitDok predicted technology trends that will impact the healthcare industry in 2017”:

1. Healthcare will transition from theory to practice in the Blockchain world. The new year will see academic and theoretical discussions move forward into pilots and applications.

2. Healthcare e-commerce will witness a boost in 2017, with more major health systems collaborating with technology companies for infrastructure with built-in cybersecurity and HIPAA compliance.

3. Telehealth will no longer be on the outskirts, pushed into the mainstream with expanded reimbursement policies, usage and outreach programs.

4. President-elect Donald Trump will likely not fulfill his promise to completely repeal the ACA, despite a Republican Party-dominant Congress and Tom Price, MD, (R-Ga.) leading the HHS.

5. Auto-adjudication will drive providers to interact with EHRs, revenue cycle management and practice management vendors.

Shifting gears, the McKesson Pharmacy Optimization Team released Five Health System Pharmacy Trends to Watch in 2017:

1. Continued Growth in Specialty Market

2. Leveraging Pharmacy Analytics to Make Strategic Business Decisions

3. Health System Pharmacy Seen as a Revenue and Margin Generator

4. Centralizing Pharmacy Operations and Improving Clinical Services

5. Future Directions for Reform and the Affordable Care Act (ACA)

Moving on to the employer healthcare world, MediaPlanet published these 6 Trends in Corporate Worksite Wellness for 2017, explaining that “here’s how corporations are using wellness programs (and this year’s lessons) to promote employee health in the coming year:”

1. Place greater emphasis on sleep

2. Continue to stay on top of wellness regulations

3. Embrace new technologies

4. Focus on total well-being, not just physical health

5. Give back to the community

6. Create a healthy work environment

And finally, also in the employer arena, Mercer shares this Top 10 Compliance Issues for 2017 Health Benefit Planning:

1. Wellness Plans (podcast): More innovative designs make it critical to know the new rules that begin on January 1, 2017.

2. Essential Health Benefits (podcast): Check those dollar limits and maximum out-of-pocket maximums against updated benchmark plans for 2017.

3. Mental Health Parity (podcast): Make sure your benefits are aligned with current law and best practices.

4. Employer Shared Responsibility: Affordability (podcast): Know the impact of opt-out cash and flex credits; 30-hour (podcast): Understand what payments must be converted to hours of service; ACA Reporting (podcast): Make sure it’s right – no more good faith standard and the old deadlines return for the 2016 reporting year.

5. Preventive care: Modify benefit terms to reflect latest recommendations and guidance on preventive care.

6. Summary of Benefits and Coverage (podcast): New model SBC must be used for open enrollments on and after April 1, 2017.

7. FLSA overtime rules: It’s not just a compensation issue – don’t forget to consider the benefits implications.

8. Expatriate group health plans: Position group health plans covering globally mobile employees to take advantage of ACA relief.

9. HIPAA privacy, security, and electronic transactions: Revisit health plans’ privacy and security obligations.

10. DOL fiduciary rule: Assess the impact on welfare plans with an investment component.

Share This Post

Share This Post