Platform mutual aid for healthcare coverage in China

by Rong Yi, Milliman, February 10, 2022

Since 2012, China has achieved near-universal health coverage through a set of sweeping national health reforms. The basic social health insurance mostly covers inpatient services. Outpatient and prescription drug coverage are not yet standardized within China, and the levels of benefits vary significantly by geography. Along with rapid economic growth, urbanization, and an aging population, a growing demand has emerged for healthcare services and for better healthcare coverage. As a result, commercial health insurance has also been growing rapidly.

Traditional life insurers have been dominating the commercial health insurance market in China. In recent years, large IT companies or their investment arms have been making headways into the healthcare space. Leveraging digital technology and direct access to individual consumers, they are actively involved in both the “2B” (business-to-business) and “2C” (business-to-consumers) fronts. They aggregate consumer data to support health insurance underwriting and sales, or act as sales channels to insurers. On the 2C front, they provide personal health and lifestyle management as add-on services to their existing users, technical solutions for patient engagement, appointment booking for office visits, mobile payment for healthcare expenses, health insurance billing, and more. These IT giants have also started to partner up with insurers to offer health insurance products. As the “new kid on the block”, the companies bring in not only capital and technology but also unique vision and strategy on how to grow health insurance business. It is against this context and backdrop that platform mutual aid was spawned and took hold in China. Platform mutual aid programs are risk-pooling and mutual aid mechanisms built on large digital platforms. In this paper, we will discuss what they are, what they are not, and how they work.

What works in China’s market may not work in other parts of the world. In fact, as we complete this article at the end of 2021, the industry has seen permanent closures of mutual aid programs started by the most prominent platform companies, such as Meituan Mutual Aid, Waterdrop Mutual Aid, and Qingsong Mutual Aid in the course of 2021.[1] The leader of platform mutual aid in terms of membership, Xianghubao, is a product developed by Ant Financial, a subsidiary of Alibaba that has gone through dramatic changes since its inception in 2018.[2] Xianghubao grew to enroll more than 100 million members in its first year, plateaued in the second year, and has started to decline in membership since the start of 2021 due to concerns over the cancellation of Ant Financial’s initial public offering (IPO). On December 28, 2021, Ant announced that Xianghubao will officially close in a month.[3]

While rapid change is characteristic of any new form of business, especially in China, the impact of platform mutual aid programs has been felt in almost all corners of China’s burgeoning health insurance market. New market rules and regulations were rolled out to regulate the platform mutual aid programs.

We do not wish to speculate on the future direction of platform mutual aid business as a whole. As independent observers, we think that the platform mutual aid model is worth studying as a business phenomenon for its concept, design, execution, and technology. It may inspire further innovations in insurtech, which hopefully would grow more robust in the future. Platform mutual aid has also challenged China’s health insurance industry and pushed it to innovate and stay competitive in parallel for its own viability.

What is platform mutual aid?

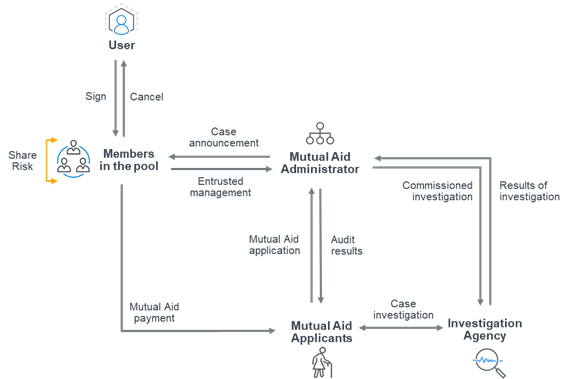

Platform mutual aid programs were born in the era of digital economy in China. They make use of platform technology to create risk pools for participating individual members to cover defined sets of medical conditions against each other. Many programs started with making fixed reimbursement payments similar to those of critical illness insurance, and later changed to making reimbursements of medical expenses. Participants typically are users of internet-based social network platforms or e-commerce platforms, with a set “desirable” personal attributes such as good credit history, long purchase history, stable income, etc. Unlike conventional commercial health insurance, participants do not go through an explicit medical underwriting process, but instead are invited to participate or automatically opted in by the platform, based on their user profile. The platform sets up the rules as to the kind of disease conditions and medical expenses eligible for reimbursement payments, analogous to a conventional health insurance policy’s product design.

Take Xianghubao as an example. Members obtain eligibility automatically if they have been a user of Alibaba’s e-commerce platform and have a good credit standing. There is no up-front membership fee. One of the most critical success factors in mutual aid is membership. After all, mutual aid and insurance programs are both risk-pooling and risk-sharing mechanisms that become more stable and cheaper to operate as total enrollment increases. In this case, Ant Financial is able to leverage consumer data collected from its affiliated businesses to prescreen participants and then leverage its large user base for program launch, both of which have low overhead and low operating costs.

To receive a payment from the program when losses occur, Xianghubao has a multistep verification process to ensure the authenticity and accuracy of the claim. After verification, each claim will also go through a public exposure period, during which the claim will be under the community’s review and approval to further reduce fraud and abuse. For cases in which the community cannot reach a consensus to approve, a jury system with representatives from the user community would make the final decision. If a claim is denied after all of these due processes, Xianghubao still has an additional channel, called "Xianghubang" (“bang” means help in Chinese), which collects charity donations on behalf of the claimant, independently of the Xianghubao channel.

FIGURE 1: PLATFORM MUTUAL AID BUSINESS MODEL

Mutual risk-sharing mechanisms are by no means new. They have existed since long before formal insurance was established, and are still quite popular in today’s world, especially in developing countries, agrarian societies, and rural areas where income fluctuations are large and formal credit and insurance markets are less robust.[4]

Traditional informal mutual risk mechanisms rely on social networks—family, relatives, friends, coworkers, neighbors in the same village, etc.—to establish the risk pool. It is conceivable that personal relationships cannot go very far, because interpersonal trust and credibility become weaker as relationships become less direct.

Platform-based mutual risk programs make use of digital technology and can reach very large numbers of participants. The participants in the same mutual program are not required to know each other, but they share a common belief, which is that the platform will take care of the credentialing of the participants, make sure that claims can be paid, and take necessary measures to combat fraud, waste, and abuse. Not every platform can do all of these easily. Only organizations with strong market positions as a digital platform, long tenure, great technology, and the ability to operate in full transparency are able to attract enough participants to form a risk pool of meaningful size.

Any mutual risk-sharing arrangement will encounter issues such as asymmetric information, adverse selection, and moral hazard, and platform mutual aid programs are no exception. Fundamental actuarial and insurance business principles still apply.

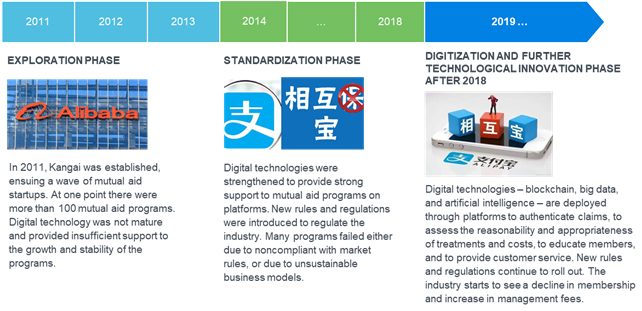

Evolution of platform mutual aids in China

China's platform mutual aid programs started about 10 years ago. In the initial years, a few dozen mutual aid programs mushroomed almost overnight. Many of the early mutual aid programs were perceived by the general public to be in a gray zone between formal insurance and charity.[5] Due to the limited number of participants, many mutual aid programs closed down quickly. One of the earliest programs that is still in existence today is Kang-Ai.[6] It was inspired by the founder’s personal experience with cancer.[7] Now it has expanded to include separate risk pools for at least 50 catastrophic conditions, such as breast cancer, pediatric blood cancer, rare diseases, chronic conditions with complications, accidental deaths, sudden deaths for entrepreneurs under the age of 50, and more. It even provides risk pools for members’ elderly parents.

Since 2016, as more large internet companies entered the competitive landscape and further crowded out smaller mutual aid programs, business models started to mature. For instance, the insurtech company Waterdrop[8] rolled out its mutual aid program, Waterdrop Mutual Aid, in May 2016. Waterdrop also recommended plans from insurance companies to mutual aid members. It was reported that close to 40% of users who had participated in Waterdrop’s mutual aid also subsequently thought about buying insurance products.[9] After all, Waterdrop’s business objective was to grow its insurance business. Mutual aid was viewed as a way of customer acquisition and retention. It also educated the users on risks and protection through educational content provided to its members. Companies such as Ant Financial (of Alibaba), Suning (mostly known as the network for household electronics and appliances), 360 (a technology company), Meituan (similar to Groupon in the United States), Didi (ride hail platform), and Baidu (internet search company, similar to Google in the United States) also established their own mutual aid programs.

Membership growth in platform mutual aid was spectacular between 2016 and 2020. In 2019, platform mutual aid programs in China enrolled about 150 million members.[10] By the end of May 2020, about 330 million people were participating in platform mutual aid.[11] Xianghubao, by Ant Financial/Alibaba, the largest platform mutual aid program in China, started in December 2018, had a membership of 23 million in January 2019, and reached 100 million members in December 2019.[12]

FIGURE 2: DEVELOPMENT OF PLATFORM MUTUAL AID

What typically happens with innovations, especially the disruptive kind, is that market rules and regulations take time to catch up to suit the new competitive landscape and social values. Additionally, from a forward-looking standpoint, heavy-handed regulation may run the risk of stifling innovation. Mutual aid shares characteristics with both insurance and charity but is neither. In practical terms, deciding which government oversight entity or entities should have the jurisdiction, what provisions are needed in the regulations, and how to execute them all still need to be sorted out in China.

In July 2017, the Ministry of Civil Affairs issued regulation on fundraising by charities using the internet platforms.[13] It stipulates that platform mutual aids are not charity fundraising activities. In August 2020, the China Banking and Insurance Regulatory Commission published an article in an industry journal[14] and identified a number of critical issues and market risks to be addressed in platform mutual aid from a regulatory standpoint. It then followed by issuing a set of rules[15] in December 2020, forbidding unlicensed entities to carry out insurance business through the internet. There is not yet a formal set of market rules specific to platform mutual aids as far as we are aware.

During the COVID-19 pandemic, coupled with the aforementioned regulatory controls, China’s platform mutual aid programs have started to see membership declines since mid-2020. Meituan Mutual Aid shut down its program in January 2021. Waterdrop Mutual Aid and Qingsong Mutual Aid both announced plans to shut down their programs in March, after nearly five years in operation. Ant Financial’s cancelled IPO negatively impacted Xianghubao’s membership, which dropped down to 92.7 million in April 2021 from its peak at 105.8 million in November 2020.[16]

Member characteristics

While the platform mutual aid industry goes through rapid changes, who are the members, and how have they been impacted by mutual aid?

In May 2021, Ant Group Research Institute published a white paper on the platform mutual aid industry.[17] It is the first of its kind for China. Through a large questionnaire-based survey, Ant collected data on about 59,000 representative individuals and analyzed the socioeconomic characteristics of the study population sample. The report finds that members participating in platform mutual aid predominantly have middle-to-low incomes, reside in less developed regions, and because they have not purchased any commercial health insurance they are concerned about the cost associated with catastrophic diseases.[18] Additionally, almost 13% of the sample did not enroll in the national basic social health insurance program, whereas, at the national level, only around 5% of the population is not enrolled in a typical year m. Almost half of the members participated in mutual aid as a family.

In terms of member perception or user experience, more than 92% of the survey respondents (through a multiple-choice question) say that it helps to "relieve the burden of medical expenses for serious illnesses."[19] Hope that mutual aid could provide long-term healthcare costs was also indicated by 40% of the respondents. In addition, a big majority expressed interest in seeing the mutual aid programs cover more disease conditions, supply adequate financial protection, and provide prompter payouts.[20]

In fact, other public sources reported in mid-2021 that Waterdrop Mutual Aid had helped more than 21,000 families during the more than five years of operation, and Xianghubao helped more than 100,000 individual members since its inception. We do not have more updated data on program payouts, especially on how many additional individuals and families have received payment since then. On the other hand, there have been reports[21] on the increase in management fees and greater inclination to deny payment requests, which seem to have resulted from reductions in membership, lack of market oversight, and changes in the general public’s sentiment about platform mutual aid as a credible and reliable source of coverage. These factors play together and propel each other, which seems to be leading the entire industry down a rapidly deteriorating path.

Technology innovations to address old problems

Membership and risks are the two most critical factors that a platform mutual aid program needs to address. To pare it down, each factor also has multiple layers of challenges underneath.

- A successful program needs a large member base to be financially viable—the law of large numbers in Insurance 101. Internet companies, social media platforms, e-commerce giants, and the like are naturally well positioned in reaching large numbers of members. After all, their users often interact with the digital platform constantly.

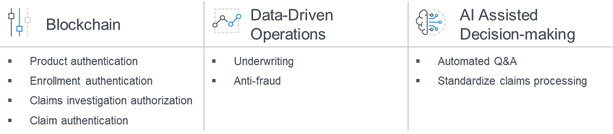

- There needs to be a screening process for the kinds of members a platform wants to enroll in a risk mutual, analogous to insurance underwriting. Traditional underwriting process in insurance can be quite costly. In the ecosystem of a platform economy, desirable member characteristics that are correlated with lower risks can be more easily identified and filtered on. In fact, most if not all e-commerce platforms and technology companies have accumulated customer data, some of which include lifestyle and other health-related information. Such information can be used to develop risk profiles at the member level for screening.

- Once members sign up, retaining their membership is yet another layer of challenge. Platform mutual aid programs compete fiercely against each other and also with traditional commercial health insurance that covers the same or similar medical conditions but with guaranteed payouts. As a result, they are compelled to lower management fees while maintaining the credibility that they will have sufficient funds to operate, to combat fraud, and to make payments. It is conceivable that without adequate investment and continuous cash flow to support the business operations, a program could easily fail before it reaches stability. This is apparent not only to the mutual aid programs themselves, but also to the participating members. Members who are risk-averse may prefer to participate in programs backed by a big widely known name, because large platforms are less likely to fail and they can also endure losses in the initial year by cross-subsidization. For instance, Xianghubao has not become profitable since its inception in late 2018. As a business unit its only source of revenue is an 8% management fee, and 40% of the management fee is spent on claims investigation and verification onsite.[22]

- Program transparency is critical in a mutual aid program that does not rely on members knowing each other directly. A transparent process in handling claims may increase the credibility of the program and reduces unnecessary disputes among participants, which may subsequently improve program efficiency. Blockchain technology, for what it is, may be a perfect solution to the transparency and credibility issue. For instance, Xianghubao uses blockchain to document each claims settlement and makes it available for the community of participants to review and monitor. In fact, blockchain technology has been used in China’s insurance industry in documentation, health statement authentication, creating excess claims, and authenticating linked insurance products from different lines of business.[23]

- Similar to traditional insurance, platform mutual aid programs need to control risks and mitigate losses. Losses are directly associated with the provision of healthcare, which varies by many factors such as practice location (e.g., urban vs. rural), setting (inpatient or ambulatory), provider specialty, training and preference, financial reasons that motivate providers and patients in different ways, etc. Even if a claim has been determined as valid, the mutual aid program still needs to determine, on behalf of the community and for the benefit of the community, what portion of the claimed losses is compensable and what portion is not. A guiding principle is that the program does not pay overuse or inappropriate care. Again, as a leader in digitization, Xianghubao applies digitized disease-specific guidelines and knowledge maps for treatment protocols as needed.[24]

FIGURE 3: DIGITAL TECHNOLOGY IN PLATFORM MUTUAL AID

Factors to consider in future growth

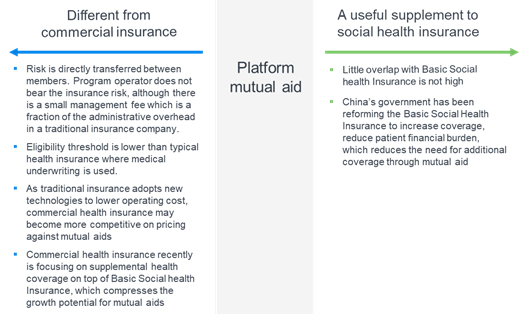

We are independent observers and do not wish to opine on the future directions of any specific company or of the entire platform mutual aid industry. However, we think that there are a few considerations to take into account with respect to the future growth of platform mutual aid and, along the same lines, how it interacts with other players in China’s healthcare coverage ecosystem. In Figure 4, we identified market and regulatory forces in the healthcare ecosystem that could either contribute to the growth of platform mutual aid or compress its growth potential. It is worth pointing out that the most important dynamic in China’s healthcare is the policy direction of the national basic social health insurance. Because China's basic social health insurance covers the basic healthcare needs of 95% of the population, its expansion or contraction will likely have significant impact on commercial health insurance, platform mutual aid, and all other stakeholders in the healthcare ecosystem.

The closure of Xianghubao, the largest player in platform mutual aid, certainly has deep implications for platform mutual aid programs and the insurance industry, which may take some time to play out. There are a few highly valuable innovations that the insurance industry can benefit from, such as the use of blockchain technology for authenticating claims, the data-driven approach to claims adjudication, the combination of clinical guidelines and artificial intelligence (AI) to identify potential waste, and the individualized and targeted member outreach and education.

Platform mutual aids also have the ability to form risk pools at speeds unheard of in traditional insurance, because it reaches members directly through an existing platform and completely bypasses the underwriting process. Insurance companies will not give up medical underwriting unless it is required, but some have contemplated simplifying underwriting to speed up the enrollment process. To do so, they collaborate with platform companies and use them as targeted marketing and sales channels.

Platform mutual aid programs are able to form risk pools for very specific risks, such as Kang-Ai’s risk pool for sudden deaths among entrepreneurs under the age of 50. For additional background, while there is insufficient empirical data on sudden deaths among entrepreneurs under the age of 50, such deaths usually make headlines in the news and cause a lot of public attention. It is as if where there is public sentiment about a perceived risk, there would be a risk-sharing arrangement that a platform can build. While this level of flexibility and nimbleness is unparalleled in commercial insurance, it certainly has challenged the way insurance companies think about product designs. Is the under-50 entrepreneur sudden death risk different from the population average? How should the risk be appropriately priced? Does it make business sense to design such a product?

FIGURE 4: RELATIONSHIP BETWEEN COMMERCIAL INSURANCE AND BASIC SOCIAL HEALTH INSURANCE

As the end of 2021 draws near, the COVID-19 pandemic is still making waves throughout the world. During this difficult time, people are ever more reliant on platforms to communicate and to do business with each other. At the same time, big platform companies are also facing increased government oversight and public scrutiny. These factors will impact the future of platform mutual aid programs.

Limitations and Caveats

In conducting the background research of platform mutual aid in the past year, we referenced numerous news articles and industry reports. We were only able to do cross-validation of the statistics cited by these sources but are unable to independently verify the statistics ourselves.

The authors are employees at Milliman and do not have any interest in any of the businesses mentioned in this article.

The observations are entirely those of the authors and do not represent those of Milliman.

The authors thank Wendy Liu for her diligent research, Guanjun Jiang, and other Milliman colleagues for peer review and input.

[1] Xuemeng, H. (April 21, 2021). Regulators stress that "licensed driving" online mutual aid platforms face choices. China Financial News Network. Retrieved January 20, 2022, from https://www.financialnews.com.cn/bx/bxsd/202104/t20210421_217028.html.

[2] Wall Street Journal (May 6, 2021). Ant Looks to Revamp a Controversial Business Without Sparking an Outcry.

[3] Reuters (December 28, 2021). Update 1 – China's largest online mutual aid platform curtain call, Ant Group's "Mutual Treasure" will be closed in one month. Retrieved January 20, 2022, from https://www.reuters.com/article/idCNL4S2TD1BJ.

[4] Informal mutual risk sharing has been well studied by economists since the late 1980s. One of the most prominent economists, Angus Deaton, awardee of the 2015 Sveriges Riksbank Nobel Prize in Economic Sciences , practically initiated a whole field within economics on how individuals and households use informal mutual risk-sharing arrangements to cope with income fluctuations in the absence of formal mechanisms.

[5] Quite a few media outlets had commented on the need to differentiate between mutual aid and charity, including the most widely read ones, such as http://www.xinhuanet.com/comments/2021-05/06/c_1127411101.htm, and http://www.xinhuanet.com/comments/2021-05/06/c_1127411101.htm.

[6] See the Kang-Ai website at http://www.kags.cn/.

[7] The story of how Kang-Ai was founded can be found on its website at https://www.kags.cn/#:~:text=%E5%9B%A0%E6%AF%8D%E4%BA%B2%E7%99%8C%E7%97%87%E5%8E%BB%E4%B8%96%E3%80%81%E7%88%B6%E4%BA%B2,%E6%97%A5%E8%87%BB%E5%AE%8C%E5%96%84%E7%A8%B3%E5%81%A5%E5%8F%91%E5%B1%95%E4%B8%AD%E3%80%82.

[8] See the Waterdrop website at https://www.waterdrop-inc.com/.

[9] Wei, J. (March 30, 2021). Waterdrop mutual aid is closed! Tens of millions of members and 4 billion financing, why did it come to the end? Sohu.com. Retrieved January 20, 2022, from https://www.sohu.com/a/458091396_157944.

[10] Ibid.

[11] Ibid.

[12] Ibid.

[13] China Ministry of Civil Affairs (July 30, 2017). Announcement of the Ministry of Civil Affairs on Issuing Two Industry Standards Including "Basic Technical Specifications for Internet Public Fundraising Information Platforms for Charitable Organizations." Retrieved January 20, 2022, from http://www.mca.gov.cn/article/xw/tzgg/201707/20170715005320.shtml.

[14] China Insurance Security Fund (August 31, 2020). Voice of Supervision: Analysis of Illegal Commercial Insurance Activities and Countermeasures and Suggestions (No. 4, 2020). Retrieved January 20, 2022, from http://www.cisf.cn/fxgc/zdtj/2730.jsp.

[15] China Government (December 7, 2020). Order of China Banking and Insurance Regulatory Commission (2020 No. 13). Retrieved January 20, 2022, from http://www.gov.cn/zhengce/zhengceku/2020-12/14/content_5569402.htm.

[16] Zhai, K. et al. (May 6, 2021). Ant Looks to Revamp a Controversial Business Without Sparking an Outcry. Wall Street Journal. Retrieved January 20, 2022, from https://www.wsj.com/articles/ant-looks-to-revamp-a-controversial-business-without-sparking-an-outcry-11620293404?page=1.

[17] See https://antcloud-cnhz02-athomeweb-01.oss-cn-hzfinance.aliyuncs.com/attachment/2020-06-13/3f900e1a-d421-49ba-a635-bb9792a0179f.pdf. The report commented that this could be a result of selection bias, meaning that individuals who did not participate in China's national basic social health insurance are more inclined to join a mutual aid arrangement to get some health coverage. On the other hand, the report also recognized that there might be a problem with underreporting in the data collection process.

[18] Ibid.

[19] Ibid.

[20] Ibid.

[21] For instance, see https://www.sohu.com/a/458130739_564023 and http://www.21jingji.com/2021/5-8/0OMDEzODBfMTYyNDU0OQ.html.

[22] Xiaoyi, H. (May 8, 2021). When the online mutual aid exits the market in 3 months, where is the mutual treasure road that has lost more than 8 million users? 21st Century News Group. Retrieved January 20, 2022, from http://www.21jingji.com/2021/5-8/0OMDEzODBfMTYyNDU0OQ.html.

[23] Zero One Think Tank (July 2020). Insurance industry, another high ground for blockchain financial applications. Retrieved January 20, 2022, from https://www.01caijing.com/article/266378.htm.

[24] Wei, J. (March 30, 2021), Waterdrop mutual aid is closed! op cit.

Share This Post

Share This Post

Reader Comments