Friday Five: Top 5 healthcare business news items from the MCOL Weekend edition

Every business day, MCOL posts feature stories making news on the business of health care. Here are five we think are particularly important for this week:

Prescription Drug Spending Varies by Private, Public Payers

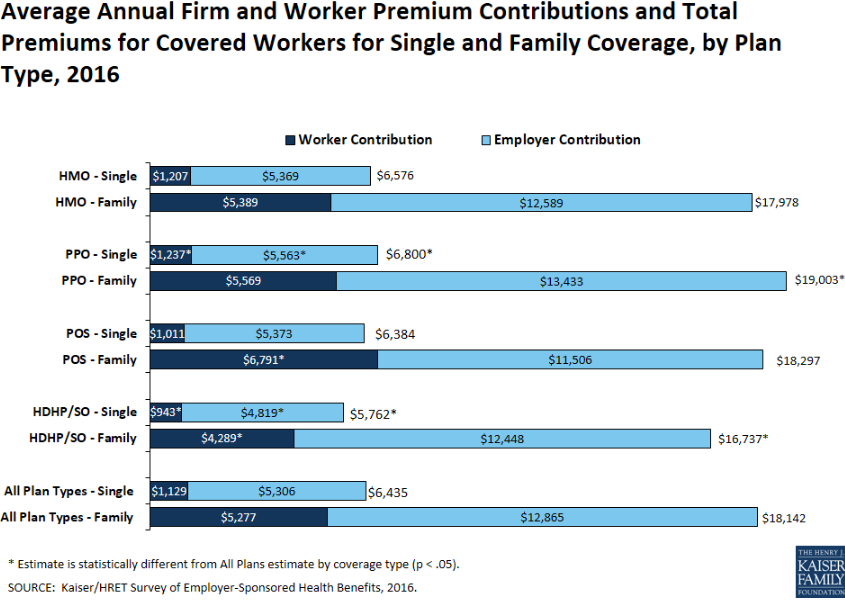

Total prescription drug spending reached $333 million in 2017, but the way that lump sum was divided among Medicare, Medicaid, and employer-sponsored health plans may reveal differences between the populations each payer covers, according to a May analysis from the Kaiser Family Foundation (KFF).

HealthPayer Intelligence

Thursday, May 30, 2019

Executive order may leave out disclosure of negotiated rates

After intense opposition from health care stakeholders, sources say language calling for disclosure of rates negotiated between insurers and health care providers could be dropped from the final version of a Trump administration executive order on health care price transparency that is expected to be announced by mid-June.

Washington Post

Thursday, May 30, 2019

The Leapfrog Group, a national watchdog organization of employers and other purchasers focused on health care safety and quality, today released its 2019 Maternity Care Report.

The Leapfrog Group

Wednesday, May 29, 2019

5 names to know at Facebook: the people behind its push into health care

When it comes to building out a health business, Facebook is often seen as having much more modest ambitions than its Big Tech competitors.

Stat News

Wednesday, May 29, 2019

J&J's Greed Helped Spawn Opioid Epidemic Oklahoma’s AG Argues

Johnson & Johnson’s greed for more sales of its addictive opioid painkillers helped create a deadly epidemic in Oklahoma that claimed thousands of lives, and the company should pay billions of dollars as compensation, the state’s top law-enforcement officer told a judge.

Bloomberg

Wednesday, May 29, 2019

These and more weekly news items on the business of healthcare are featured in the MCOL Weekend edition, along with the MCOL Tidbits, and more, for MCOL Premium level members.

Share This Post

Share This Post