Hot Healthcare M&A Market Starting to Cool

By Clive Riddle, May 6, 2016

Irving Levin Associates reports that healthcare merger & acquisition activity, which has been relatively overheated, is starting to cool a little. Lisa E. Phillips, editor of Irving Levin’s Health Care M&A News tells us “the slowdown in deal volume in the first quarter of 2016 might simply be fatigue setting in after a record-setting year in 2015. Also, some buyers are still figuring out where the best opportunities are, as the shift to value-based reimbursements gains momentum.”

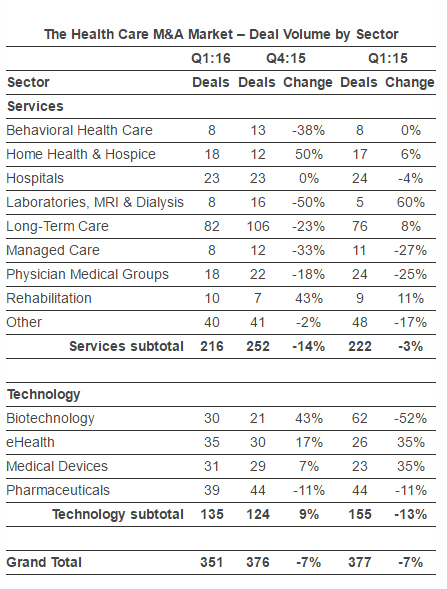

Health Care M&A News states that “health care merger and acquisition activity began to slow down in the first quarter of 2016. Compared with the fourth quarter of 2015, deal volume decreased 7%, to 351 transactions. Deal volume was also down 7% compared with the same quarter the year before. Combined spending in the first quarter reached $79.5 billion, an increase of 87% compared with the $42.5 billion spent in the previous quarter.”

Here’s a snapshot the publication provided of the quarter’s activity:

How big was 2015? Bigger than 2014, which was also a huge year. Irving Levin’s Lisa Phillips says “health care mergers and acquisitions posted record-breaking totals in 2015. The services side contributed 62% of 2015’s combined total of 1,503 deals, which is even higher than 2014, when services deals accounted for 58% of the deal total.” A separate Irving Levin publication, the Health Care Services Acquisition Report, cites that “deal volume for the health care services sectors rose 22%, to 936 transactions versus 765 in 2014. The dollar value of those deals grew 183%, to $175 billion, compared with $62 billion in 2014. Merger and acquisition activity in the following services sectors—Behavioral Health Care, Hospitals, Laboratories, MRI & Dialysis, Managed Care, Physician Medical Groups, Rehabilitation and Other Services—posted gains over their 2014 totals. The exception was the Home Health & Hospice sector, which declined 33% in year-over-year deal volume.”

In the hospital sector, for 2015, they report that “activity remained strong in 2015, up 3% to 102 transactions, compared with 99 transactions in 2014. An average of 2.6 hospitals were involved in each transaction, compared with an average of 1.8 in 2014 and 3.3 in 2013.” Philips noted that “several deals resulted from the mega-mergers of 2013,” and that “we’re seeing more sales resulting from bankruptcies, especially in states that have not expanded Medicaid coverage.”

Post a Comment By

Post a Comment By  Riddle, Clive |

Riddle, Clive |  Friday, May 6, 2016 at 09:01AM tagged

Friday, May 6, 2016 at 09:01AM tagged  Finance|

Finance|  Trends & Strategies|

Trends & Strategies|  health plans

health plans

Reader Comments